As a component of QUT’s Marketing, Planning and Management, students are required to conceive, develop and promote a start-up business. The following report was prepared in collaboration with Alana Day, Remy Chard, Karen Koh and Napat Chinprapinporn.

Let’s Spoon presents a new way to couple. Instead of a warm cuddle in bed, people can enjoy a great hot chocolate anywhere they like. The mission of Let’s Spoon is to couple fine quality chocolate with an indulgent, social experience.

Situation Analysis – Macro-environment

| Environment | QUTopia Trends and Issues | National/International Trends and Issues | Implications for our product |

| Political/Legal | QUTopia enforces strict laws governing the marketplace. This ensures equal contribution to the business process, a fair dealing environment and prevents misleading and deceptive conduct. Fines are imposed to offenders who are found liable for breach of these regulations (Russell-Bennet, 2013). | Consumer confidence levels during election years are consistently low (Featherstone, 2013.

Political instability makes consumers hesitant to purchase big-ticket items (Featherstone, 2013). The recent redundancy of Queenslanders in the public sector has also pushed unemployment to a decade high, and driven down disposable income (Business Spectator, 2013). |

The economic uncertainty caused by political instability may make consumers hesitant to purchase big ticket items, but a small indulgence from Let’s Spoon could be just what the consumer needs. The product will be offered in an individual serving that provides an indulgent way to treat themselves without great financial risk. |

| Economic | The average QUTopian’s salary is $281. This can be considered disposable income due to the lack of expenditure required to pay for necessary expenses like household rent, bills etc. This set income (as designated by Qutopia laws) also restricts the amount each Qutopian has to spend at both market days.

The exchange rate between real dollars and QUTopia dollars is around 25 to 1. |

The number of Australians aged over 65 is expected to increase from 13% to 25% by 2056 (Kemp, 2013). This results in a decrease to the labour force and tax base. With the increasing need for expenditure in the health and aged care services, and the deficit in revenue, economic downturn is a likely outcome (Reference 5).

Tough economic climate with financial trouble plaguing most of Europe and USA, Australian consumers will be circumspect, and transact with reliable institutions (reference 6). |

Increase in baby boomers creates more disposable income and therefore spending on luxuries and fine foods has risen (Kerin et al, 2008).

Having a set amount of disposable income available for both market days, Let’s Spoon must consider how best to capture the Qutopian dollars and encourage repeat purchasers in Market Day 2. There is also a need to demonstrate value in the exchange rate as most people would not be used to spending $50 on a cupcake. |

| Sociocultural | Overall there are 281 people in QUTopia consisting of 217 females and 89 males. | Occupy Wall Street movement has left consumers with an awareness of corporate responsibility. Investors want to know how their companies are contributing back to society (Ross, 2012). Companies must ensure their CSR is authentic, with the forever-cynical Australian market (Ross, 2012).

Nationally, there is a return to local identity, a rise in community and a refocus on connection (McCrindle 2013) |

Let’s Spoon is attempting to reduce the carbon footprint by using environmentally friendly wooden spoons and recycled-paper packaging materials. It is further pushing its CSR strength by offering a “Speeonfeed the world” option where Qutopian dollars can be traded for real money donations to World Vision. This supports McCrindle research’s idea of community and connection.

With more females to males in the Qutopian marketplace, the female demographic was chosen as a more desirable target market for Let’s Spoon. Women aged 18-24 fitting the chosen ‘Adventurous Spooners’ segment were chosen to help refine our target market effectively making marketing strategies more focussed and specific. |

| Technology | Largest number of videos on QUTopia TV posted this semester.

Limited power sites at QUTopia Limited opportunities to reach market through television, radio, press or mobile. |

46% of Australians now own smartphones, 37% of whom have purchased something over the internet on their phones (Ross, 2013). The 5million Gen Y’s in Australia account for 44% of mobile usage (Duncan, 2013). With the proliferation of smart-phones and tablets, mobile marketing and mobile commerce has become the most desirable channel for promoting, selling and purchasing (Ross, 2013). Companies are also beginning to leverage their own media distribution channels, with the increasing cost of Google, Microsoft and Major newspaper services (Ross, 2013). | Research has found that talking online and via social media the most effective way of delivering a message to the younger demographic and that Gen Y’s are the largest users of mobile in Australia (Diageo 2013, Duncan, 2013). Facebook has been used as a way to build a data base quickly and in turn helping Let’s Spoon reaching the consumer via their mobile devices to build product awareness and encourage sharability. |

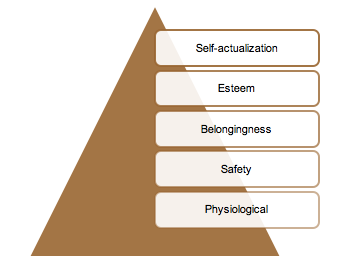

Situation Analysis – Market Need

Market need was identified through using Malsow’s hierarchy-of-needs, alongside recent research into contemporary Australia. Let’s Spoon’s fulfils basic physiological needs of food to sustain life (Belch et al, 2012). It also meets higher-order needs of belongingness, aligning the marketing of the product with the social activity of “spooning” and thereby resonating with consumer needs for belongingness, love and affection.

Relating this to the contemporary Australian marketplace, McCrindle Research identifies changing consumer influences. Here, the purchasing perspective becomes increasingly important, moving from functional/situational to provide utility and aspiration. Relating this to Let’s Spoon, it is likely that people will buy the product not for the food value (Maslow’s physiological need), but for the social currency, the need to help others and to reward themselves. The value of the product will be measured by intrinsic and emotional drivers.

Situation Analysis – SWOT

In the food-saturated QUTopian marketplace, Let’s Spoon must successfully differentiate itself and create awareness. As mentioned in the previous section, it must also align with consumer emotional needs for reward and connection, rather than being positioned merely as a food-type. Let’s Spoon should capitalize on the time-poor, reward-seeking population, using the target market’s existing media-channels

| Strengths [Internal]

|

● Small team focused on integrated tasks and good communication

● Australian owned and operated ● Strong branding ● Introductory stage of product lifecycle generating interest, excitement and filling a niche market ● Take home product that can be used as a reward/treat for self or others. ● Visible corporate social responsibility program in the “Let’s Spoon Feed the World” charity fundraiser. |

Weaknesses [Internal]

|

● Small team results in smaller reach of networks

● Low budget ● Introductory stage of product lifecycle with a lack of awareness and presence in the market ● Limited market research and product trial ● Limited media channels ● Cannot afford to be seen as another food option. |

| Opportunities [External]

|

● Time poor population in need of a reward

● Cross-merchandising with other complementary QUTopia companies ● Promotions through social media and mobile |

Threats [External]

|

● Operating in a saturated food market with a large number of direct and indirect competitors

● Physical layout of QUTopia with many competitors in close proximity. ● Current health-conscious population may see Let’s Spoon’s product as promoting obesity. |

Situation Analysis – The Competition

| DIRECT COMPETITOR

(similar chocolate/sweet products and packaging) |

INDIRECT COMPETITORS

(other specialty food retail goods including baked goods, health goods and cold drinks) |

| Cocoa Delight: gourmet brownies designed for sharing | Game of Scones: sweet and savoury baked goods with game of thrones theme |

| Sweet’s land: chocolate covered strawberries | Imagine Pancakes: Dutch pancakes with polaroid take home picture |

| The Traveller’s Secret: international confectionary paired with travel essentials | Le Petit Parisienne: French patisserie products |

| Sweet Sucre: pre-packaged selection of popular confectionary | Mac-moi: macaroons |

| The Fourth Artisan: premium handcrafted beverages | Moody Munch: cupcakes categorised by moods |

| Cookie Corner: pre-packaged cookie ingredients in jars | Spongecakes: themed pancakes served on a stick |

| The Cookie Factory: pre-packaged cookie ingredients in various packaging | Waffle On: waffle baskets with various toppings |

| Teepee Tree: loose leaf tea with samples to try | Banana Bar: banana flavoured food products |

| DIRECT COMPETITOR

(similar self-rewarding, indulgent, take home products) |

Bonkers Bites: energy bars |

| Beauty Pantry: Body Scrubs | Bullrush: energy drink |

| Hizzenhers: Body Scrubs | Cold Paradise: cool drinks |

| Holy Floss: pre-packaged and fresh fairy floss | |

| Iced: tailored iced tea | |

| QUTopia Beverages: homemade non-alcoholic beverages | |

| Shake it Up: milkshakes in a variety of flavours | |

| SodaNova: five different flavoured spider drinks that represent different personalities |

Competitor strengths and weaknesses are identified (Kotler, et al 2007) in the table below, to predict likely response, plan-of-attack and to derive competitive advantage. The strengths of our food competitors include product diversity and pre-packaging. In a marketplace where there is only so much that one can eat, Let’s Spoon differentiates itself through being a two-step, take-home treat. Rather than pre-packaged chocolate strawberries/confectionary, our product must be paired with a hot drink to transform into its actual use. In this way, it is more like the facemask from Little Beauty Pantry that transforms the natural ingredients into a reward for your skin.

| Sweet’s land | The Travellers Secret | Little Beauty Pantry | |

| Target market(s) | Chocolate lovers of all ages. | Young optimists with a particular desire to travel. | Health conscious consumers. |

| Product | Pre-packaged chocolate-covered Strawberries. | International Confectionary pair with travelling essentials. | Homemade facial masks and scrubs made from ingredients straight from the kitchen pantry. |

| Price | According to previous QUTopia data, similar confectionary products were competitively priced. | According to previous QUTopia data, similar experience based products were premium priced. | According to previous QUTopia data, similar luxury products were premium priced. |

| Place | Stall 5, QUTopia market day | Stall 25, QUTopia market day | Stall 17, QUTopia market day |

| Promotion | Guerilla marketing in Wk 9; Standard Point of purchase activity. | Guerilla marketing in Wk 9; Standard Point of purchase activity; Facebook. | Guerilla marketing in Wk 9; Standard Point of purchase activity; Facebook. |

| Potential competitive barriers | Similar range of product line poses the threat of a substitute (Porter, 2008) eg. Dark, white and milk chocolate. | Creates strong cognitive behaviour through using similar metaphorical branding techniques (Chitty, 2012). | According to Meredith (2007), Indirect substitutes with a low level of learning pose a high competitive risk factor. |

| Potential strengths and weaknesses of competitors | Pre-packaging and bundling the products could create the perception of more value for money (Daw, 1998). The broad nature of their target market however, could weaken the product branding (Solomon, 2011). | Creates differential benefits through coupling confectionary with related travelling goods (Solomon, 2011). Complementary products can have positive and negative impacts on profits (Porter, 2008). | Product customisation and choice can be seen as strength as it increases consumer utility (Arora et al, 2008). Too much customisation however, can lead to lowered product differentiation in a competitive context due to other companies offering better matching products (Arora et al, 2008). |

| Our likely response(s) | Create a perceptual map and place ourselves at a different spectrum as this helps to position ourselves differently in the minds of consumers (Traflet, 2009). | Create competitive advantage through out performing aspects of the value chain eg. Packaging customer service, point of purchase display and promotion (Solomon et al, 2011). | Create a perceptual map and place ourselves at a different spectrum as this helps to position ourselves differently in the minds of consumers (Traflet, 2009). |

| Attack/ Avoid & Why | Attack, because we are both targeting a similar market, so in order to achieve a 15 percent market share we need to dominate. | Attack, due to strong emotive branding and targeting a market similar to our own. | Attack, due to similarity of product benefit. |

Market Segmentation, Targeting and Positioning – Segmentation

Bernkowitz, Kerin, Hartley and Rudelius defined market segmentation as “dividing up a market into distinct groups that (1) have common needs and (2) will respond similarly to a marketing action” (Kerin et al, 2006). The following three segments, each identifying a personality within QUTopia Census, have been identified.

| The Adventurous Spooners | The Settling Down Spooners | The Wooden Spooners | |

| Geographical description

|

· Current location: Brisbane, QLD, Australia

· Living at home or in a share house/student accommodation with the other like-minded people · Residing in metropolitan area · Centrally to transport/studying facilities |

· Current Location: Brisbane, QLD, Australia

· Residing in fairly metropolitan area |

· Current location: Brisbane, QLD, Australia

· Living in dense residential suburbs of Brisbane in close proximity to schools and transportation · Residing in lower metropolitan areas on city fringe |

| Demographic description

|

· Female dominated population (QUTOPIA statistics, 2013)

· Young 18-30 (Generation Y) · Low-disposable income · Living in family-sized household or share-size household (3-4 persons) · Renting · Single/boyfriend/ |

· Both Females and Males

· Young 18-30 (Generation Y) · Living in shared accommodation · or transitional living between living at home/with partner · Currently renting looking at opportunities for possible home ownership · Couple sized household: 2 persons · Long-term relationship |

· Both females and males

· Mature 30+ · Predominantly Generation X and Baby Boomers · Family-sized household: mother, father, 2 children (4 persons) · Home ownership · Married/defacto with children |

| Psychographic description | · Young Optimism (Refer to Appendix C) | · Something Better (Refer to Appendix C) | · A conventional family life

· Visible Achievement (Refer to Appendix C) |

| Socioeconomic

|

· Low disposable income

· Student currently studying · Part-time occupation |

· Higher disposable income

· Student almost completed studies · Part-time to full-time occupation |

· Higher disposable income

· Part-time study/finished degree · Full-time occupation |

| Behavioural description | The Adventurous Spooners is a self-indulgent spoon that is eager to experience all there is to offer. They are forward and impulsive and seek to discover all opportunities in life. They value uniqueness, humour and appreciate originality, especially in their spooning partner. This spoon is technologically savvy and is an active social networker, conscious of projecting the right image. | The Settling Down Spooners is a high-achieving spoon with a tendency to show off. They are content in their long-term relationship; however still strive for further value and worth. This spoon values quality and likes to be rewarded for their achievements. Their competitive flare leads to overcompensating and they can find themselves in precarious situations. | The Wooden Spooners is a family orientated spoon that puts others before itself. It is a delicate and mature spoon that is looking to provide a better experience for its family. The Wooden Spooner is reliable and honest and is not concerned with image but instead the functionality. |

Market Segmentation, Targeting and Positioning – Target Market

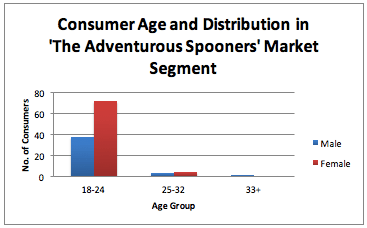

Let’s Spoon employ concentrated marketing whereby one segment is selected and a large share of this market is captured. Based on the graphs below, the target market selected is ‘The Adventurous Spooners’, as it is the largest (Graph 1) and most closest aligned with product values. Furthermore, our target market focuses on females, aged 18-24, the largest group within ‘The Adventurous Spooners’ segment (Graph 2).

Graph 1: Market segments percentages in QUTopia (male and female)

Graph 2: Consumer Age and Distribution in ‘The Adventurous Spooners’ Market Segment

Market Segmentation, Targeting and Positioning – Positioning

The key motivators for the target market of females aged 18-24 to purchase the Let’s Spoon products are:

- Delicious and affordable Indulgence

- Self-reward

- Social connection

Let’s Spoon is positioned as an affordable indulgence, where the great taste of fine chocolate is coupled with the satisfaction of self-reward. It’s something wonderful and low-cost you can do for yourself or your friends, who also deserve spoiling. It also offers social connection through its unconventional name and the act of donating to the less fortunate.

The value proposition is that Let’s Spoon answers consumers’ needs for self-indulgence by offering an affordable chocolate treat that is more delicious and easier-to-prepare than any of its competitors.

Market Segmentation, Targeting and Positioning – Critical Issue Analysis

To prevent major issues arising on market day, or manage them if they do occur, it is necessary identify potential critical issues.

| Critical Issue | Why is it critical | How to avoid or rectify |

| Limited stock | If Let’s Spoon is limited in the stock they can sell, this will greatly affect the profitability of the company and lost-opportunity for potential repeat purchasers. | As the product is able to last across both marketdays Let’s Spoon can make a large number more than is needed for marketday 1. Whatever is not sold then can be sold the following week. |

| Ruined stall experience | Because there are a number of competitors it is important to differentiate Let’s Spoon through the stall experience and customer service. | The store will be of an open plan for people to wander into and escape the chaos of marketday. Staff will be on hand to assist in both sales and to ensure a pleasurable visit. |

| Incorrect pricing | As aforementioned, the saturation of competitors will force Let’s Spoon to compete on price, while still upholding their brand. | A number of signs will be printed for the day so as to easily interchange between prices if necessary. |

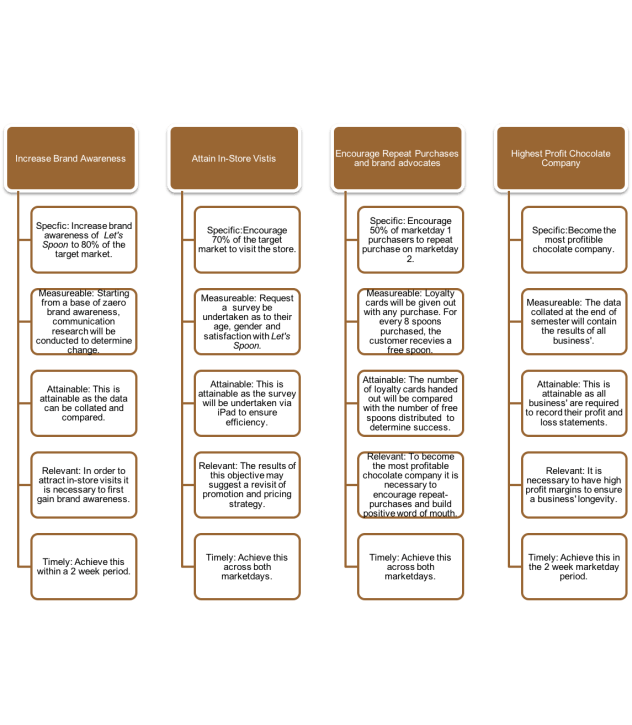

Marketing Objectives

Marketing objectives have been developed to activate our target market by exposing the brand, attaining in-store visits, encouraging repeat-purchasers and brand advocates, growing donations to World Vision, and fulfilling the profit-driven objective.

Let’s Spoon will also incorporate their charitable “Spoon-Feed the World” initiative as an objective. Over the two market days, Let’s Spoon aims to gain 100 donations, which will be tracked and visibly displayed on a big spoon whose red line grows with donations. To achieve this, for every three referrals that any one person gives to the store, another donation is contributed. This builds brand awareness, attains in-store visits and encourages brand advocacy. Let’s Spoon can build on World Vision’s existing customer-loyalists, as well as appealing to compassionate QUTopians.

Marketing Mix – Product Strategy

According to Solomon et al (2011) there are three layers of a product: The Core, Actual and Augmented. Let’s Spoon’s products are classified non-durable consumer, as it provides a temporary benefit, is low-involvement and price-sensitive. Therefore it is important to establish differentiation to ensure customers consider our product as a specialty product (Solomon et al, 2011).

The core product consists of basic benefits the product provides for consumers (Solomon et al, 2011). Let’s spoon is providing the basic needs of comfort, warmth and indulgence through coupling chocolate with a warm drink. This two-step process is differentiating our product from other food retailing in QUTopia.

The actual product is the physical good that supplies the desired benefit. This includes the appearance, styling, packaging, the donated gourmet chocolate and brand name (Solomon et al, 2011). Let’s Spoon’s quirky positioning carries across its branding, packaging, overall appearance and promotional strategies and therefore creates synergy and increased customer value (Kerin et al, 2008).

The augmented product is the actual product plus other supporting features including warranty, installation and after-sales service (Solomon et al, 2011). In this sphere, Let’s spoon has initiatives such as “Spoon-Feed the world” where every ten QUTopia dollars donated are matched by a ten-cent donation to charity and after-sales service using Facebook as a point of contact.

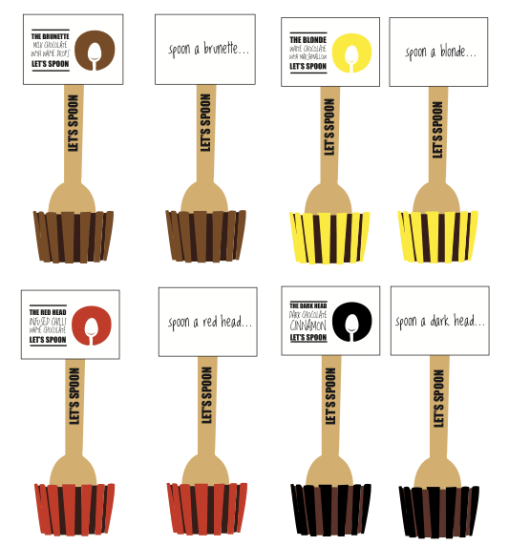

Let’s Spoon implemented a product differentiation strategy to augment the original promotion framework (spooning) with hair colour.

| Correlating flavour | Correlating flavour | |

| Hair colour | Market Day 1 | Market Day 2 |

| Blonde | White chocolate and marshmallows | White chocolate and M&Ms |

| Brunette | Milk chocolate and white chocolate drop | Milk chocolate and coffee |

| Dark heads | Dark chocolate and cinnamon | Dark chocolate and sea salt |

| Red Heads | White chocolate infused with chilli | Milk chocolate infused with chilli |

| Effect | ||

| Promotional and product strategy | Market Day 1 | Market Day 2 |

| Variations in product

(Differentiated in branding by different hair colours) |

Product

· As the product is in the introduction phase of the product life cycle, four individual flavours have been formulated to introduce to the market. Promotional · Let’s Spoon have chosen to identify different flavours of chocolate dipping spoons using different hair colours. It was felt this style of differentiation would augment the framework of the company’s branding strategy for its products, creating a stronger brand identity. · To enhance the promotional strategy, Let’s Spoon will enlist the help of male volunteer sales staff to capture the attention of the target market group more (Adventurous Spoons, female young optimists aged 18-24) |

Product

· To encourage return buyers and, Let’s Spoon will introduce four new variations flavour to its product line, creating an incentive for return custom Promotional · Maintaining the same branding strategy, the four hair colours will again be used to differentiate between the four ‘new’ flavours being introduced to the market. · Male volunteer sales staff will be used again in Market Day 2 once again in the hope of capturing the attention of the target market group |

Appendix – Product Packaging

Marketing Mix – Pricing Strategy

The broader objectives of Let’s Spoon must be supported by suitable pricing strategies, the following six-stage price plan was implemented (Solomon, Hughes et al, 2011):

| Pricing Objectives | · Increasing sales or market share

As seen in section 2.2, Let’s Spoon maintains a competitive advantage over the company’s direct competitors. This allows pricing to remain high and sales objectives to be achieved. · Profit The profitability of Let’s Spoon is integral both for the sustainability across both marketdays and to ensure the company’s sponsors see the value in investment. Let’s Spoon aims to achieve $3,000 profit. · Competitive effect Let’s Spoon’s high pricing is intended to effect the marketing efforts of the competitors by giving consumers the illusion of a better quality, more valuable product. · Customer satisfaction To ensure Let’s Spoon obtains $3,000 profit the company must provide customer satisfaction and loyalty. This will be achieved through the implementation of a loyalty scheme. |

| Based on demand curve | · Let’s Spoon’s product has elastic demand, as the price of the product will have large effect on the amount demanded. Research has shown that an increase in price may actually result in an increase in the quantity demanded because consumers see the product as being more valuable (see diagram below) (Solomon et al, 2011). This is reflected in Let’s Spoon’s pricing strategy. |

| Determine costs | Variable costs

· Spoons $16 · Chocolate $0 (Sponsored) · Flavourings $0 (Sponsored) · Packaging materials $0 (Sponsored) Total variable costs = $16 Fixed costs · Wages $1300 · Stall rent $350 · Promotional $70 · Branding $26 Total fixed costs = $1746 Break-even analysis was then conducted on the obtained information above. |

| Pricing environment evaluation | Economic

· Due to the nature of the Qutopia market, it is assumed that the market is in a positive growth market where Qutopians have high levels of discretionary income and are not price sensitive. Competition · The ‘Other specialized food retailers’ share of the Qutopia marketplace is comprised of a large number of sellers in the same category selling a slightly different product, resulting in a monopolistic competitive environment. · Let’s Spoon will not be too concerned with matching the exact price of competitor’s products, basing product pricing on the basis of its costs and profit targets instead. Consumer trends · Based on the census data, the higher number of women (128) within the Qutopia population and the relatively high percentage of individuals identifying themselves in the ‘young optimist’ demographic (49%) creates an excellent target market for Let’s Spoon to focus its pricing strategies. · The female ‘young optimist’ segment identifies with image, style and social connection (Solomon et al, 2011). As a result, this segment will be less price sensitive and willing to spend their discretionary income on small luxuries. |

| Pricing strategy | New product pricing

Let’s Spoon has chosen to implement a penetration pricing strategy. This strategy is to charge an introductory lower price to attract buyers, winning customer’s acceptance first to help build market share. Once this introductory period is over, the strategy may change to increase the price as demand increases. |

| Develop a pricing tactic | It is the intention of Let’s Spoon to implement two pricing strategies

· Individual product purchase, where buyers have the option of only purchasing individual or multiple units of the product at the regular price, or · Multiple product price bundling, where the buyers have the option of buying four units (one of each flavour) as a single package for a special price (Solomon, Hughes et al, 2011). |

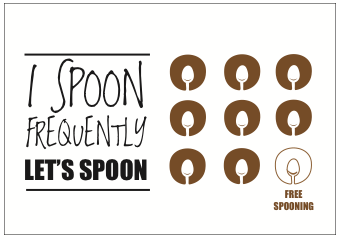

Appendix – Customer Loyalty Card

Marketing Mix – Placement Strategy

To achieve a distribution strategy that facilitates movement of products from producers to final customer (Solomon et al, 2011), Let’s Spoon uses direct channel retail distribution. This intermediary-free distribution allows Let’s Spoon to serve customers better and at a lower price, while maintaining control of product quality, pricing and delivery. Let’s Spoon has chosen exclusive distribution coverage, limiting distribution to a single outlet, enabling Let’s Spoon to better recoup costs and increase profit.

Let’s Spoon implemented the four-stage channel planning strategy by Solomon et al (2011).

Placement strategies are two-fold. Firstly, the development of distribution strategies is based on setting objectives to support organizational marketing goals. Secondly, Let’s Spoon’s product will be available when, where and in the quantities that customers want at a minimum cost (Solomon et al, 2011). Internal and external environmental influences were also evaluated to optimize channel structure.

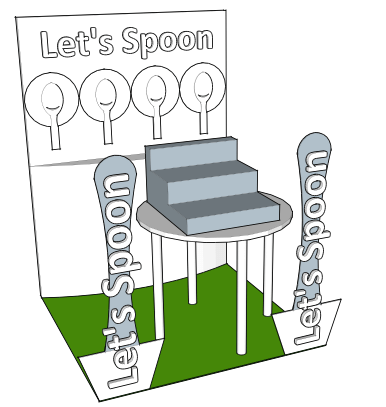

Let’s Spoon stall design took into consideration an on site market visit.

| Market Day 1 | The product is in the introduction stage of the product life cycle, where the goal is to get first-time buyers to try the product, creating awareness and making the consumer believe it is something that they want or need (Solomon et al, 2011). To achieve this, the stall’s design will reinforce product branding to create intrigue, curiosity and demand attention. |

| Market Day 2 | The product will span both the introduction and growth stage, with a combination of new potential consumers and hopefully repeat customers. Here, the stall should still retain a strong visual impact and create a memorable sensory experience to continue, attracting new customers while reminding repeat custom. |

| Stall Design | Let’s Spoon has a cheeky, quirky, playful and flirty brand personality, which is reflected in the design of the market stall. Walking into the stall should be akin to walking into an idea. By inviting the consumer to treat themselves or to buy some social connection or international compassion,Let’s Spoon evokes and creates a stall with a congruent aesthetic and effortlessly sets the stage for the service pitch. Designed with the target market of female, young optimists in mind, the stall design is playful and fun with a cheeky overtone in the verbal branding. The stall should be a cohesive and seamless presentation of the company’s brand personality selling the idea, therefore allowing the product to sell itself (Gazebos Australia, 2013). The stall will feature astro turf flooring, a clean and fresh white backdrop with bright graphics in the same style as the company branding overlaid with bold text graphics. When they walk into the store, they know they are ready to Let’s Spoon (Refer to Appendix G). |

Appendix – Stall Design

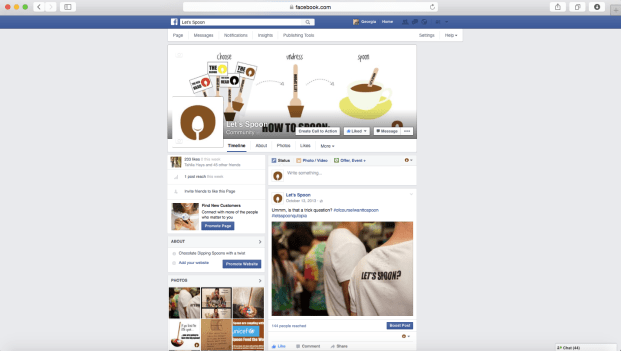

Marketing Mix – Promotional Strategy

To inform consumers impressions of a brand (Solomon et al, 2011), Let’s Spoon chose four avenues of promotion, described in table below, to ensure product benefits are communicated efficiently and effectively.

| Advertising Strategy | Actions of Advertising Strategy | Aims of Advertising Strategy |

| Interactive Marketing | Interactive Marketing is a means of providing information that is easily accessible and creates dialogue with consumers (Solomon et al, 2011). Facebook creates a customized direct communication channel to our consumers in their favourite medium. It both empowers Let’s Spoon to disseminate ideas and offers and also provide means to elicit a feedback and a measurable response from individual customers. Additionally, it will grow sharability as Facebook users share with their friends (Refer to Appendix E). | |

| Buzz Marketing | Word of Mouth | According to Kerin et al (2008), Word of Mouth (WOM) is ‘the most powerful information source from consumers’. This form of communication is viewed as authentic because it is generated by consumers. To ensure that this strategy is carried out effectively, Let’s Spoon needs to be consistent in the delivery of both the product and the level of customer service. If this is achieved, the word of mouth strategy will enhance the growth of sales and awareness amongst customers both inside and outside of our target market. WOM can also be rewarded through donations to “Spoonfeed the world”. |

| Sales Promotion | Frequency Programs | A customer loyalty card will be implemented to offer a free product for multiple purchases over time. This will reinforce customer loyalty and on-going sales and encourage WOM (Refer to Appendix F). |

| Samples | Samples of our product will be distributed to encourage consumers to try the product and then buy the product (Kerin et al, 2008). | |

| Temporary price reductions | Temporary price reductions will be used as a short-term venture to instigate interest in the business and stimulate short-term sales (Solomon et al, 2011) at the beginning of market day one. Additionally, this could form a back-plan to stimulate product turnaround if sales are slow. | |

| Competition | A competition will run to entice consumers to purchase our product and provide a means to record consumer’s information for evaluation. The prize will be a giant chocolate dipping spoon. Entry into the competition is gained through various avenues to including Facebook likes, product purchasing and Instagram hastags. This way we can gain easier access to the market if they are located across multiple communication channels. | |

| Personal Selling | The company staff will be talking directly to customers in order to enhance the brand and deliver its unique message.

On market days, both the company staff and volunteers will be walking around in order to gain maximum exposure throughout the market |

To control to whom the presentation is made and minimise wastage coverage (Kerin et al, 2008).

To add a personal layer to the promotional strategy (Kerin et al, 2008) that aligns with Let’s Spoon’s vision of handmade, authentic and an intimate experience. This also allows us to guage the buyer’s reaction to our message and initiate instant feedback. Staff will have to ensure that a consistent message is delivered to all consumers (Kerin et al, 2008) through prior sales training. |

Appendix – Facebook Page

Marketing Mix – Messaging

The message strategy is that Let’s Spoon is the new way to couple. Instead of a warm cuddle in bed, you can enjoy fine quality chocolate coupled with an indulgent social experience.

The message, like the brand name encodes the company mission statement, through play-on-words and provocative, cheeky branding using the conventional meaning of spooning. This brand personality is amplified through store design and all phases of marketing planning to resonate with ‘The Adventurous Spooner’s’. Let’s Spoon uses hair colour as a way to differentiate the flavours of the product line and augments the framework of the promotional strategy, ‘spooning’, that provides both informative and persuasive content for which a consumer will act.

Marketing Mix – Branding

Let’s Spoon uses private branding only, producing the entire product mix in-house from design, production, packaging to final product stage. This forms a key competitive advantage, by controlling product quality, minimizing risk of error/miscommunications, whilst maximising clarity and consistency of branding.

The branding is expressed through logo, packaging and corporate colours. Colour has a subconscious effect on every part of our lives and is an invaluable tool to optimize marketing response (Empower yourself with color psychology.com. 2013). Let’s Spoon features brown as our corporate colour. Beside the immediate association with chocolate, the colour brown relates to quality, friendly, approachable, sensual, sensitive and warm.

The logo has been designed as simple, instantly recognizable and transferrable across all marketing avenues including packaging, labels, staff uniforms and stall design.

Sales Forecast and Budget – Market size, demand and potential

The QUTopian market is based on 219 people, with an average income of $250, plus additional tourists estimated at a further 50 people. Let’s Spoon seeks to reach a target market of 60 people and achieve a market share of 15%. Purchase frequency is an estimated 2 per person.

According to QUTopia Business Registrations, 55 businesses are registered, 23 of these in the food-retailing industry. Hence Let’s Spoon will operate in a highly competitive marketplace, using the outlined segmentation and targeting strategies to optimize outcomes.

- Predicted market share

| Turnover (Total sales) | Marketshare | Profit | Product (No. of units sold) | Profitability % | Price (Av. price per unit) | |

| Your company | 5,850.00 | 15.94% | 2,240.00 | 180 | 40.65% | 32.50 |

| Competitor 1: Sweet’s Land | 5,600.00 | 15.26% | 1,640.00 | 200 | 29.29% | 28.00 |

| Competitor 2: The Traveller’s Secret | 5,800.00 | 15.81% | 2,030.00 | 120 | 35.00% | 48.33 |

| Competitor 3: Little Beauty Pantry | 5,700.00 | 15.54% | 2,100.00 | 100 | 36.84% | 57.00 |

| Competitor 4: Hizzenhers | 4,950.00 | 13.49% | 1,820.00 | 90 | 36.77% | 55.00 |

| Competitor 5: Cocoa Delight | 4,890.00 | 13.33% | 2,710.00 | 80 | 55.42% | 61.13 |

| Competitor 6: Sweet Sucre | 3,900.00 | 10.63% | 2,890.00 | 120 | 74.10% | 32.50 |

| Total industry | 36,690.00 | 100.00% | 15,568.00 | 890 | 42.43% | 41.22 |

| Average industry profitability | 42.43% | |||||

- Sales projection

| Market Potential (a) | 217 |

| Target Market Size (b) | 60 |

| Purchase Frequency per person (c) | 2 |

| Estimate Market Share (d) | 15% |

| With Sales Project Formula = (b)*(c)*(d) | |

| 60*2*0.15 = 18 | |

| Let’s Spoon can predict 18 sales | |

- Budget

| Capital ($QUTpia): | $4,000 |

| Projected Unit Sales: | 92 |

| Min Unit Price ($QUTpia): | $30 |

| Max Unit Price ($QUTpia): | $35 |

| Average unit Price($QUTpia): | $32.50 |

- Sales and Production report

| No. of units | ($Q) QUTopia currency | |

| 01. Sales | ||

| 02. Sales price per unit | $32.5 | |

| 03. Total number of units produced | 200 | |

| 04. Total number of units sold | 20 | |

| 05. Stock on-hand (left over inventory) | 180 | |

| [03 – 04] | ||

| 07. Total turnover | $650 | |

| [2 x 4] |

- Break-even point

| Fixed Costs: | |

| Wages: | $1,300 |

| Stall Purchase: | $350 |

| Advertising | $0 |

| Total upfront Fixed Costs: | $1,650 |

| Variable Costs per unit: | |

| Chocolate (Donated) | $0.00 |

| Spoon | $0.10 |

| Package | $0.10 |

| Stationery | $0.25 |

| Total Variable Costs: | $0.45 |

| Average Sales per unit: | $32.50 |

| Revenue per unit: | $32.05 |

| Breakeven Point (Units): 67 | |

- Profit and Loss Statement

| Notes | ($AUD) Real Currency | (SQ) Qutopia Currency | Subtotal | Total | |

| CAPITAL | |||||

| Amount of Start up capital | $4,000 | ||||

| Amount of capital retained | $2,350 | ||||

| PROFIT & LOSS | |||||

| Income | |||||

| Turnover (total sales) | $5,850 | $5,850 | |||

| Cost of Sales (Production) | |||||

| Materials (Purchase of Spoons) | $110 worth of Chocolate, Spoons and packaging donated | $16 | |||

| Wages/Salaries | $1,300 | $1,316 | $4,534 | ||

| GROSS PROFIT | |||||

| Distribution | |||||

| Stall Cost | $350 | ||||

| Delivery Costs | $1 | ||||

| Total | $351 | ||||

| Expenses | |||||

| Other Expenses: Uniforms | $70 | ||||

| Other Expenses: Branding | $26 | ||||

| Total Expenses | $97 | ||||

| NET PROFIT BEFORE TAX | $4,087 | ||||

| Profitability of the organisation (Calculated as net profit/turnover) | 69% | ||||

Marketing Metrics

The marketer must understand their target market quantitatively, measuring new opportunities and understanding required investments (Farris et al, 2010). In order to quantitatively measure Let’s Spoons’ outcome, the marketing objectives will be measured through the key metrics described below.

| Objectives | Metric | How the data will be collected | How it will be measured |

| Increase brand awareness of Let’s Spoon to 80% of the target market in two weeks

|

Awareness | Post market day communication research using target market interviews | Starting from a base of zero brand awareness, communication research will be conducted to determine change in awareness of target market. |

| Encourage 70% of the target market to visit the store in two weeks

|

Store Visitation | Request a survey be undertaken as to their age, gender and satisfaction with Let’s Spoon. | Measured as number of visitation over time |

| Encourage 50% of marketday 1 purchasers to repeat purchase on marketday 2.

|

Loyalty | Loyalty cards will be given out with any purchase. For every 8 spoons purchased, the customer receives a free spoon. | Count number of repeat purchases |

| Become the most profitible chocolate company at Qutopia 2013. | Profit | The data collated at the end of semester will contain the results of all business. | Calculate the chocolate business with the highest profit margin. |

Implementation Plan – Pre-Market Day

| Action | Team member responsible | Deadline |

| Product production | All members | Week 10 |

| Packaging of product | Product and Promotions Manager | Week 10 |

| Construction of stall | Distributions Manager | Week 10 |

| Preparation of necessary promotional materials |

Implementation Plan – At Market Day 1

| Action | Team member responsible | Deadline |

| Market day stall set up | All members | Market Day 1 |

| Sales | All members and Volunteer sales staff | Market Day 1 |

| Market day stall clean up | All members | End of Market Day 1 |

| Consolidation of market day revenue | Marketing Manager | Market Day 1 |

Implementation Plan – Post-Market day 1

| Action | Team member responsible | Deadline |

| Review of marketing strategies | Promotions Manager | Week 11 |

| Review of distribution strategies (including effectiveness of stall design) | Distributions Manager | Week 11 |

| Review of pricing strategies | Pricing Manager | Week 11 |

| Review of promotional strategies | Promotions Manager | Week 11 |

| Potential more product production | All members | Week 11 |

Implementation Plan – Market Day 2

| Action | Team member responsible | Deadline |

| Market day stall setup | All members | Market Day 2 |

| Sales | All members and volunteer sales staff | Market Day 2 |

| Market day stall clean up | All members | Market Day 2 |

| Consolidation of market day revenue | Marketing Manager | Market Day 2 |

Implementation Plan – Post-Market Day 2

| Action | Team member responsible | Deadline |

| Reflection on how changes in marketing strategies affected sales | Marketing manager | Week 12 |

| Review of how changes in distribution strategies affected sales | Distribution manager | Week 12 |

| Review of how changes in pricing strategies affected sales | Pricing Manager | Week 12 |

| Review of how changes in promotional strategies affected sales | Promotions Manager | Week 12 |